About ICAEW

ICAEW is a world leading professional membership organisation that promotes, develops and supports more than 144,000 chartered accountants in 160 countries. It provides its members with knowledge and guidance, and ensures ICAEW Chartered Accountants are meeting the highest ethical and technical standards. It acts in the public interest offering insights into business and the economy that help to shape government policy and regulation.

ICAEW is a world leading professional membership organisation that promotes, develops and supports more than 144,000 chartered accountants in 160 countries. It provides its members with knowledge and guidance, and ensures ICAEW Chartered Accountants are meeting the highest ethical and technical standards. It acts in the public interest offering insights into business and the economy that help to shape government policy and regulation.

Ineo is ICAEW’s only Partner in Learning in the Czech Republic: Recognised as an ICAEW Partner in Learning, working with ICAEW in the professional development of students

The ACA qualification

The ACA, the ICAEW chartered accountancy qualification, provides a combination of technical knowledge, professional skills and practical experience. It involves developing not only technical knowledge but also ethical values and professional scepticism.

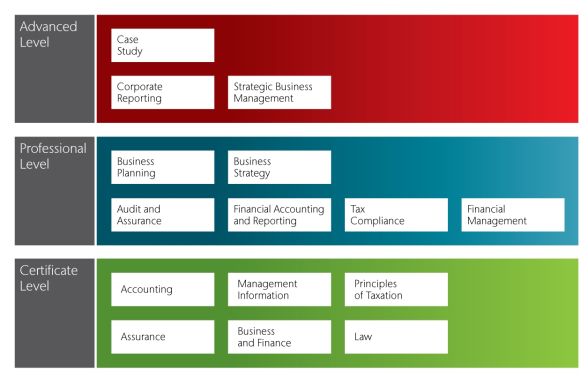

To obtain the necessary technical knowledge and professional skills, there are 15 exam modules, over three levels as follows:

Certificate Level

- It’s a standalone qualification and can be completed outside of a training agreement,

- Six modules which introduce students you to the fundamentals of accountancy, finance and business,

- Each module has a 1.5 hour computer-based assessment, which can be completed in Prague and other locations in the Czech Republic at any time regularly throughout the year, and

- Most ACA students complete the Certificate Level within the first year of their training agreement.

Accounting

Module covers the techniques of double entry accounting and how to apply its principles, including:

- maintaining financial records

- adjustments to accounting records and financial statements

- preparing financial statements

Assurance

Module covers the assurance process and fundamental principles of ethics, including:

- concept, process and need for assurance

- internal controls

- gathering evidence on an assurance engagement

- professional ethics

It is possible to obtain a credit for prior learning if you have studied Czech Auditing methods to a suitable level, for example with KAČR (see below).

Business and Finance

Module covers how businesses operate and how accounting and finance functions support businesses, including:

- business objectives and functions

- business and organisational structures

- the role of finance and the accountancy profession

- governance, sustainability, corporate responsibility and ethics

- the external environment

Law

Module covers the principles of UK law, including:

- impact of civil and criminal law on business and professional services

- company and insolvency law

- impact of law in the professional context

It is possible to obtain a credit for prior learning if you have studied Czech Law to a suitable level, for example with KAČR (see below).

Management Information

Module covers how to prepare essential financial information for the management of a business, including:

- costing and pricing

- budgeting and forecasting

- performance management

- management decision-making

Principles of Taxation

Module covers the general objectives and types of UK tax, including:

- objectives, types of tax and ethics

- administration of taxation

- income tax and national insurance contributions

- capital gains tax and chargeable gains for companies

- corporation tax

- VAT

It is possible to obtain a credit for prior learning if you have studied Czech Taxation to a suitable level, for example with KAČR (see below).

Professional Level

- Another six modules which build on the knowledge gained at Certificate level,

- Each module has a 2.5-3 hour exam,

- These modules are flexible to fit around your training agreement, so they can be taken at any time regularly throughout the year (March, June, September, December) , and;

- The Business Planning and Business Strategy are more advanced modules, and they link to the Advanced Level certificate of the qualification.

Audit and Assurance

This is a 2.5 hour open book exam (you can bring prescribed text into the exam). Module covers critical aspects of managing an assurance engagement, including:

- legal and other professional regulations, ethics and current issues

- accepting and managing engagements

- planning engagements

- concluding and reporting on engagements

Financial Accounting and Reporting

Ths is 3 hour open book exam (you can bring prescribed text into the exam). Module covers the preparation of complete single entity and consolidated financial statements and extracts from those statements, including:

- accounting and reporting concepts and ethics

- single company financial statements

- consolidated financial statements

Financial Management

This is a 2.5 hour exam. Module covers how to recommend relevant options for financing a business, recognise and manage financial risks and make appropriate investment decisions, including:

- financial options

- managing financial risk

- investment decisions and valuation

Tax Compliance

This is a 2.5 hour open book exam (you can bring prescribed text and tax tables into the exam). Module covers how to prepare UK tax computations for individuals and companies, including:

- ethics and law

- capital gains, income, inheritance and corporation tax

- national insurance contributions

- VAT and stamp taxes

It is possible to obtain a credit for prior learning if you have studied Czech Taxation to a suitable level, for example with KAČR (see below).

Option 1: Business Planning:Taxation

This is an 2.5 hour open book exam where you can bring any text you like. The module covers how to identify and resolve UK tax issues that arise in the context of preparing tax computations, and to advise on tax-efficient strategies for businesses and individuals, including:

- ethics and law

- taxation of corporate entities and unincorporated businesses including partnerships

- personal taxation

Option 2: Business Planning: Banking

Option 3: Business Planning: Insurance

Business Strategy

This is a 2.5 hour exam. Module covers how businesses develop and implement strategy, including:

- strategic analysis

- strategic choice

- implementation and monitoring of strategy

Advanced Level

- The Corporate Reporting and Strategic Business Management modules have been designed to test your understanding and strategic decision making at a senior level.

- You will be presented with complex real-life scenarios, which expand on the Professional Level modules.

- The Case Study must be completed last, and is aimed to test all of the knowledge gained throughout your studies training.

- The Case Study presents a complex business issue which encourages you to problem solve, identify the ethical implications and provide an effective solution.

Advanced Level modules are not available for credit for prior learning. The Case Study exam must be attempted last.

Corporate Reporting

This is a 3.5 hour open book exam. The module covers:

- applying technical and analytical techniques to resolve compliance and business issues arising from providing auditing services and preparing and evaluating corporate reports

- applying technical knowledge and professional judgement to determine alternative solutions to corporate reporting issues, considering client and stakeholder needs

- considering commercial impact and ethical issues arising from recommendations on compliance and business issues

Strategic Business Management

This is a 3.5 hour open book exam. The module covers:

- demonstrating business and ethical awareness at strategic, operating and transactional levels

- demonstrating quantitative and qualitative skills to solve business problems and make realistic recommendations

- applying technical knowledge, including strategic analysis, risk management, corporate governance, financial management, corporate reporting and assurance

- requires use of technical knowledge and professional judgement to apply appropriate models, analyse data from multiple sources and develop appropriate solutions

Case Study

This is a 4 hour open book exam. The module covers:

- requires demonstration of knowledge, skills and practical application from multiple areas of the syllabus

- tests professional skills in the context of a specific business issue

- demands ability to analyse financial and non-financial information

- requires demonstration of professional and ethical judgement

- development of conclusions and recommendations required

- relates to how students will be expected to work

Credits for prior learning / exemptions

Credit for prior learning (CPL), also known as exemptions, are available for some of the Certificate and Professional Stage exam modules. If you have studied a related subject at university, you may be eligible to apply for exemptions for up to eight modules. In addition, ICAEW have an agreement (link in Czech) with the local Professional Body KAČR whereby it is possible to obtain certain credits for prior learning if you have successfully passed the relevant equivalent papers set by KAČR.

If you are interested in finding out more about this you should contact ICAEW directly.[/vc_column_text][/vc_column][/vc_row]